Budget day allows Chancellor George Osborne to take to the parliamentary stage for an uninterrupted hour to deliver his political agenda. After four years of preaching the need for unremitting austerity to revive the economy, in this, his fifth Budget, the time had come to retune his message in preparation for the general election just over a year away. He is after all a very rich boy determined to continue his chosen hobby of parliamentary politics, while pretending to run the British economy. David Yaffe reports.

At the end of his speech Osborne declared: ‘We’re building a resilient economy. This is a Budget for the makers, the doers, and the savers.’ This is far from the truth. As Mark Carney, the Governor of the Bank of England and an Osborne appointee, said in mid-February, the economic recovery is ‘neither balanced nor sustainable’. Osborne is clearly aware of this bleak situation as he said in his speech: ‘We’re putting Britain right. But the job is far from done. Our country still borrows too much. We still don’t invest enough, export enough or save enough.’ The Budget did little to change this.

What the Budget was primarily concerned to do was to target the votes of older people, from relatively prosperous pensioners to defecting Tory voters attracted by the ‘populism’ of the United Kingdom Independence Party (UKIP) of Nigel Farage. This was the intent behind the radical changes to savings and pensions in the Budget.

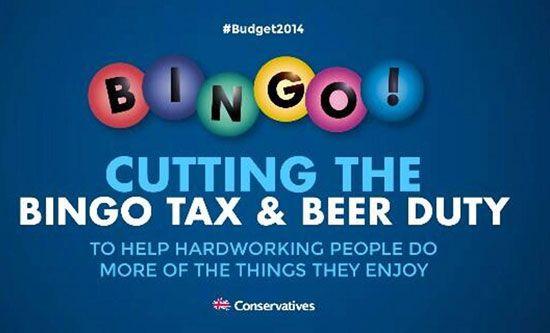

Those who are more likely to vote were intended to be the main beneficiaries of the very limited payouts from this Budget. At the last general election in 2010 some 76% of the over 65s voted, compared with 44% of the under 25s. 58% of UKIP voters, according to the polls, are over 55. However UKIP voters are generally not very well off. In the Budget there was a patronising attempt to appeal to ‘hardworking people’, not only supporters of UKIP but also Labour voters in less prosperous areas of the country. Measures such as the halving of the bingo tax from 20% to 10%, the penny off the price of beer and the freezing of other alcohol duties were designed to this end. Osborne remarkably even visited a bingo hall in Cardiff a week after the Budget. The utter contempt these rich boys have for the working class was displayed by the Tory chairman Grant Shapps who tweeted a picture after the Budget: ‘Bingo. Cutting the Bingo tax and beer duty: To help hardworking people do more of the things they enjoy.’ He asked his followers to re-tweet it, ‘to spread the word’.

Main Budget measures

Public finances are in a dreadful state, exacerbated by the savage austerity programmes of this reactionary government. Osborne has little room to manoeuvre and almost nothing to give away. The Budget was fiscally neutral, taking as much as it gave. Scarce resources are being used to target potential Tory voters and to give tax breaks to businesses in yet another attempt to stimulate capital investment. Austerity will continue for the vast majority of working people into the foreseeable future. The Financial Times described the measures in the Budget as ‘high in political resonance and low in fiscal cost’.

The radical changes to savings and pensions will benefit a fairly restricted number of relatively well-off middle-aged and elderly people. Few people can save £15,000 a year, the new ISA (tax free saving) allowance, raised from £11,520 in the current year. New National Savings pensioner bonds will be introduced, which allow up to £10,000 to be invested at higher interest rates than currently available, but there will be a limited supply. Those taking a gamble on premium bonds can invest substantially more, with the maximum permitted holding being raised by steps from £30,000 to £50,000. These measures will have no impact on the 8 million households that have no savings at all. However, every one of the top 10 locations for savings has a Tory MP.

The decision to allow those reaching retirement age to draw down their funds as required instead of buying an annuity (which provides a regular income for the rest of your life) is a popular measure given the very low annuity rates and the deep distrust of pension providers and insurers. It may be popular but it is very risky and could have long-term consequences that have been ignored by a government concerned only with the coming general election. At present 90% of the 400,000 savers who retire each year buy annuities worth in total around £14bn. A Financial Times poll after the Budget showed just 4.5% would now buy an annuity against 42% who would take out their total fund. The National Association of Pension Funds is concerned: ‘A number of people will run through their pension pots far too quickly…We fear these reforms, without careful scrutiny, will leave a large swathe of people vulnerable to poverty in old age.’ Other critics believe that those with large pension assets will invest them in property, so strengthening the buy-to-let property boom and accelerating the rise of house prices. The Pensions Minister Steve Webb told the BBC he was ‘relaxed’ about how people spend their money: ‘If people do buy a Lamborghini but know that they’ll end up just living on the state pension, that becomes their choice’. His stand was supported by the government. What fantasy world do these government ministers live in? A Lamborghini sports car costs around £150,000.

Under pressure from the Liberal Democrats, the personal tax allowance will be raised to £10,500 in April 2015. This will give back very little to most tax payers. Fiscal drag has meant that the 40% tax threshold has dropped in real terms and an extra 1.4 million people have joined that bracket since the coalition came into office. There are now 4.4 million taxpayers in the 40% band. Despite pleas from the Tory right Osborne has not found the funds to raise the threshold in line with inflation for what are potential Tory voters.

To further stimulate investment and exports, the Budget doubled the annual business investment allowance against corporation tax to £500,000 and extended this to the end of 2015, after which it would normally fall back to £25,000. It also doubled lending under the export finance scheme to £3bn and cut the interest rate on that lending by a third. Osborne announced measures to cap the carbon price floor, a tax on electricity generated from fossil fuels, at £18 per tonne. The carbon floor price, introduced last year, was intended to rise annually in order to encourage manufacturers to switch to greener fuels. It will cost around £7bn over the four years 2016-2020 and save medium size manufacturers some £50,000 on their annual energy bill, and households around £15. Priorities do change for this government. Once promising to create the ‘greenest government ever’ it is now getting ‘rid of all the green crap’ (both statements attributed to Prime Minister Cameron).

Finally the Budget promises no end to austerity for the working class. The chancellor was directing his remarks to Labour when he said: ‘Securing Britain’s economic future means there will have to be more hard decisions; more cuts. The question for the British people is: who has the credibility to deliver them?’ Central to this strategy is a ‘welfare cap’ that would put a limit on welfare spending. It will be set at £119bn in 2015-16 rising with inflation to £127bn in 2018. The ‘welfare cap’ includes housing and disability benefits as well as tax credits, but excludes state pensions and pensioner benefits as well as the Jobseeker’s Allowance. A Commons vote was tabled to establish this measure. Labour accepted this challenge with alacrity and Ed Miliband and Ed Balls led their troops to vote with the government in favour of this savage attack on the poorest sections of the working class.

A bleak economic future

Osborne boasts of taking difficult decisions, which are achieving the largest reduction in both the headline and the structural deficits of any major advanced economy in the world. ‘Before we came to office’, he said, ‘the deficit was 11%. This year [the Office of Budget Responsibility (OBR) says] it will be 6.6%. Next year, 5.5% – down a half. Then it will fall to 4.2%, 2.4% and reach 0.8% in 2017-18. In 2018-19, they are forecasting no deficit at all – instead, at plus 0.2%, a small surplus.’ He does not tell us that his targets set in previous Budgets have not been met and have been delayed by over two years. Total debt is forecast to peak at 78.7% of GDP in 2015-16, two years later and higher than his June 2010 forecast of 70.3% for 2013-14.

Recent analysis of these statistics has raised important questions about the overall performance. The OBR has argued that although the headline borrowing is down once you take into account the unexpected upswing in the economic cycle – higher than expected growth and rising employment – borrowing figures are actually worse. So the OBR’s estimates of the underlying deficit have deteriorated as it has become more pessimistic about the economy’s capacity for a prolonged period of recovery. It has been estimated that there is a further £20bn black hole in public finances.

Economic growth is forecast to reach 2.7% in 2014, but with that growth driven by debt-fuelled consumer spending and inflated house prices, nothing has been done to improve the potential output of the economy. The stronger demand has not improved the underlying supply (productive) potential. The fall in unemployment has its counterpart in the stagnating productivity of the British economy. Spare capacity is falling too quickly and limiting the growth prospects for the economy. If this continues Britain will enter an unsustainable and inflationary boom.

‘Rebalancing’ the economy towards exports and investments has failed. Trade is not expected to contribute to growth for the next five years. As a percentage of GDP, the last two quarters of 2013 have produced the largest balance of payments quarterly deficits in the history of the UK, at 5.6% and 5.4% of GDP respectively. Most of the decline arises from the falling income of UK overseas assets compared with the income from foreign owned assets in the UK. The financial services sector continues to play a central and dominant role in the parasitic British economy. It is significant that the bank levy was not raised in the Budget for the first time since it was introduced four years ago. ‘Deleveraging’ is failing, with households almost as indebted as they were in 2008 when boom turned to bust. The OBR predicts that in 2018 the ratio of the gross household debt to income will spring back to its crisis peak of 170%.

The prospects for the working class are bleaker still. Real wages have been falling since 2010 and are 6% below their pre-crisis peak. They have been falling for 44 out of the 45 months the coalition has been in office. On current plans, public spending in 2018 is to be cut to its lowest share of national income since 1948. On this measure only a third of spending cuts have been implemented so far. If these plans are not stopped there will be more devastating cuts in our public services and savage falls in living standards for millions of working class people. We have no choice now but to organise to stop this.

Fight Racism! Fight Imperialism! 238 April/May 2014