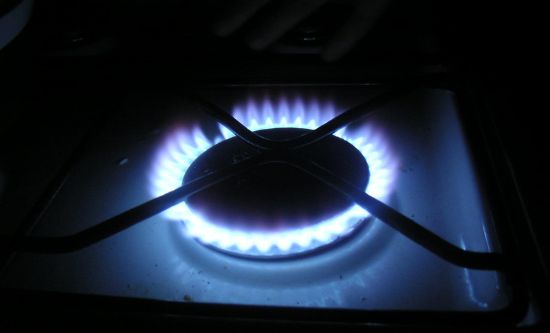

In mid-September, CF Fertilisers, a US company and the largest fertiliser producer in Britain, abruptly closed down production. Soaring natural gas prices had made it unprofitable to continue. Carbon dioxide (CO2) is a by-product of fertiliser manufacture and the company supplies 60% of the British market. CO2 is needed among other uses for the production of fizzy drinks including beer, making dry ice to keep food fresh for storage and transport, for stunning animals before slaughter and for nuclear power where it is used as a coolant. CF Fertilisers makes CO2 as a by-product of its fertiliser production at two plants, one at Billingham in Teesside and another in Cheshire. Emergency talks were held with the government in an effort to get CF Fertilisers to restart production. Late at night on 21 September, it was announced that production would restart immediately at the Billingham plant. DAVID YAFFE reports.

A temporary fix

The details of the deal so far remain a secret. Environment Secretary George Eustace said that financial support would be available for three weeks to restart production at the Teesside factory. CF Fertilisers’ Chief Executive Tony Wills told the Financial Times ‘We were haemorrhaging cash. I was unaware of the [CO2] situation’. He continued: ‘We were as surprised as anyone by the dependent and critical nature of our CO2 to the UK’s industry. That’s why I jumped on the plane to meet with the government’. CF Fertilisers shut the plants because the soaring prices of natural gas, from which their primary product ammonia derives, had made them unprofitable. The result of their action, however unintentional, cut off a critical supply of food-grade CO2 essential for the food supply chain in this country. But it is still only a temporary fix. Although the Teesside plant is to reopen after a government support package was agreed, CF Fertilisers said it would remain in operation only until alternative CO2 supplies could be found.

This clearly is unacceptable to industry groups and they are demanding a change to guarantee the supply chain. ‘We need more than a temporary fix,’ said Gavin Partington, Director-General of the British Soft Drinks Association, ‘It can’t be right that a company whose product is critical to the food and drink supply chain can be allowed to close without adequate warning’. This, however, is the inevitable product of capitalist production. A major utility, British Gas, is privatised. The market is deregulated and the outcome, left to market forces, is unplanned and anarchic. This is a system which offers rich rewards for the few and leaves the vast majority struggling to survive.

Soaring energy prices

Ten years or so ago the supply of gas and electricity was dominated by six private companies – British Gas, EDF Energy, EonUK, Npower, ScottishPower and SSE. The high profit margins and the bonuses for their executives were often called into question. So-called regulatory reforms that made it easier to enter the industry saw a surge in household suppliers from 12 in 2010 to more than 70 in 2018, creating one of the world’s most ‘liberalised’ markets. Newer companies tempted customers away from the dominant six through cut-price deals. The price caps introduced by the government in 2019 to curb ‘rip-off energy bills’ drove some companies out of the market. The current energy crisis is leading to a dramatic reduction in energy suppliers. Since August 2021 seven small suppliers have already gone bust and more are expected to follow before the end of the year. In total almost two million households have lost their supplier this year and this number is expected to soar. By the end of winter, according to Baringa Partners, the industry might shrink to as few as ten suppliers from about 70 suppliers at the start of this year. Ofgem, the energy regulator, will automatically switch affected customers to the larger suppliers. The energy crisis is leading to a growing monopolisation of the market.

Wholesale gas prices have soared to an all-time high in recent weeks resulting from a global surge of demand for gas following a cold winter that left gas storage facilities depleted, a quicker than expected global rebound from the pandemic and a shortfall in wind power due to Britain’s least windy summer since 1961. A series of nuclear reactor outages and the recent shutdown of a major power cable that brings electricity from France have added to this demand. Gas prices are now more than five times their level two years ago and will lead to household bills rising by 12% in October.

A winter of discontent

UK factories and steelmakers make up a significant proportion of the UK’s energy use and are highly exposed to rising energy prices. Steelmakers have already suspended production during hours of peak electricity demand where prices have reached well over £1,750 a MWh, more than 2,900% higher than the average price over the last decade. Other industries are likewise affected.

The high energy prices will lead to some of the most expensive energy bills in the past ten years and drive an extra half a million people into fuel poverty. About 85% of the UK’s domestic heating comes from natural gas. Together with the announced £20 cut to Universal Credit, increasing fuel and food prices, the Joseph Rowntree Foundation has estimated that a typical low income family will be £1,750 worse off by next April.

The government’s complacent, laissez faire response to the energy price surge is to accept this reality and take no corrective action. The right-wing Business Secretary Kwasi Kwarteng is typical. Kwarteng insists that ‘there is no question of the lights going out, of people being unable to heat their homes’ as the energy crisis intensifies. Kwarteng has ‘categorically’ ruled out any subsidies or grants for larger energy suppliers. The policy of ‘let the market decide’ has led to a lack of gas storage capacity in the UK. This has left the UK paying significantly higher wholesale prices at daily auctions than other European countries which have built up reserves over recent months. Instead of storing gas the UK, in line with its free market ideology, has increasingly relied on a ‘just-in-time model’ for its supply. The working class will pay dearly for this. It faces a winter of growing impoverishment unless it organises to fight back against this reactionary right-wing government.*

* Information takent from issues of The Guardian and Financial Times between 20 and 24 September 2021.

Fight Racism! Fight Imperialism! 284 October/November 2021