Ruling Class Rampant

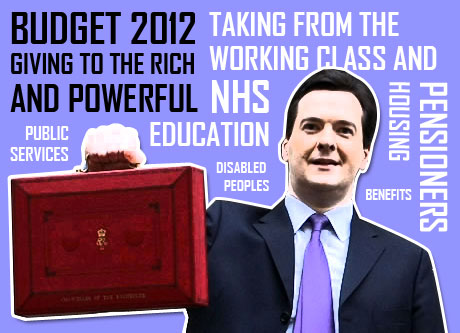

This Budget was a political statement of future intentions of the British ruling class. It will reward a tiny privileged minority, while carrying out the most sustained and ruthless attack on the living standards of the working class in recent times. David Yaffe reports.

The Budget contained little of substance to alter the abysmal course of the British economy since the financial crisis of 2008, but it was clear who would benefit and who would pay as the ConDem government continued with the economic plans set out when it came to power in 2010. Chancellor George Osborne, as he made clear in this Budget, was sticking rigidly to his spending cuts, of which 80% are still to come.

In last year’s Budget (see FRFI 220) Osborne spoke of ‘reforming the nation’s economy’ for ‘enduring growth and jobs in the future’. The outcome could not have been more different. Growth in 2011 at 0.8% was less than half that expected at the time by the Office for Budget Responsibility (OBR). In the three months to January 2012 there were 2.67 million people unemployed, 8.4% of the labour force, the highest rate since 1995.

This Budget took measures to change this outcome by reforming Britain’s tax system to one that is ‘more competitive for business than any other major economy in the world’. Yet after all the Budget changes were processed by OBR, it said that they would have ‘limited’ effect on the economy, raising output by 0.1% by the end of 2016. Growth in 2012 was expected to remain at 0.8% – an almost stagnant economy. Business investment in 2012, forecast to grow by 7.7% in November last year, has now been downgraded to 0.7%. Unemployment is predicted to peak at 8.7% this year and edge down marginally to 8.6% in 2013 – continuing misery for millions of people. Economic output is still at 3.8% below its 2008 peak and not set to reach that level again until at least 2014. Reality is a hard taskmaster, giving short shrift to neo-liberal illusions.

However the essence of the Budget lies not in its economics but its political intent. The government wants to test the waters for further attacks on working class living standards in order to sustain Britain’s parasitic and decaying capitalist system and with it the wealth and power of the corporate and financial elite. It can do this now because so far it has faced little or no resistance from the organised working class movement or from the so-called parliamentary opposition. A brief look at the significant measures of this Budget shows this political and ideological offensive.

The rampant arrogance of this government is best exemplified by the decision to cut the 50p rate of tax to 45p on the incomes of those earning over £150,000 a year, under the pretext that the tax makes Britain not only uncompetitive but also raises insignificant revenues due to tax avoidance. It feels confident enough to do this while cutting tax credits and benefits for working class families and ending the extra age-related tax allowances for pensioners.

Raising the tax allowances for standard tax payers to £9,205 from April 2014 in turn was designed to deflect attention away from this gift to the millionaires. So was the increase of stamp duty on the small number of houses costing £2m or more and the derisory general tax avoidance measure – so-called anti-abuse rule – to be introduced in 2013.

Let us look at the facts. The 50p cut will benefit 300,000 earners mainly from the financial and business services sector. A person earning £1m a year could save £42,250. Many in the banking sector will save even more as this year’s bonuses demonstrate. The increase in stamp duty to offset this giveaway affects only about 3,000 each year of those who would gain from the cut in the 50p tax rate – almost irrelevant.

The increase of the standard tax allowances will mean a saving of about £170 this year and a further £220 in 2014 for those in work. It will lead to about 840,000 of the lowest paid being taken out of tax altogether, not the millions claimed by the government. However poorer working class families who get housing and council tax benefit will receive just £33 a year from the tax threshold rise because if their income goes up their benefits go down. One third of all adults will receive no benefit from the increase in the tax threshold because they already earn too little to pay tax. Couples working part-time will see their income drop on average by more than £2,700 from 6 April when the number of hours which must be worked to obtain working family tax credit will be increased from 16 to 24 hours a week. 840,000 are expected to lose child benefit from 2013, some £1,700 a year for households with two children. While this, at present, affects well off middle class families, it is yet another attack on universal benefits, a central principle of the ‘welfare state’.

The Chancellor tried to portray the withdrawal of the extra age-related allowance for pensioners as a ‘simplification’ of tax allowances. He is both deceitful and stupid, as the immediate forthright protests made clear. It will mean over 4.4 million pensioners aged 65 and over, with an income between £10,000 and £24,000, will be worse off in real terms. Richer pensioners will be unaffected.

A further cut in corporation tax, down 2 percentage points to 24 % this April, and 22% in 2014/15, is intended to encourage investment and jobs. This will save businesses some £6bn by 2015-16. Corporation tax now accounts for only 9% of total tax receipts. Given that companies in Britain already have £700bn sitting on their balance sheets and are not investing because the profit outlook is so poor, this cut in corporation tax is little more than a gift to the government’s corporate friends.

While giving to the rich and powerful, Osborne has planned for six successive years of decline in state spending. He is planning a further cut of £10bn from welfare spending from 2015 on top of the £18bn up till then. 730,000 public sector jobs will be cut by 2017. We are clearly not all in this together.

Fight Racism! Fight Imperialism 226 April/May 2012