When President Biden signed his $1.9 trillion coronavirus relief bill into law on 12 March 2021 it was greeted as a game changer. Commentators heard echoes of Roosevelt’s New Deal from the 1930s and Lyndon Johnson’s 1960s Great Society reforms. The Financial Times announced: ‘It cements a leftward shift in US politics and economics that has gained traction during the coronavirus crisis, affording government a far bigger role in solving problems in society than it has enjoyed in recent decades’ (13/14 March 2021). The spending package was described as intended ‘to make the world’s largest economy more equitable … the $1.9 trillion bill reveals and reinforces a new enthusiasm for the state’. Farewell, then, to neo-liberalism and the paeans to private enterprise and the free market that have guided government policy since Thatcher and Reagan in the 1980s. TREVOR RAYNE reports on the American Rescue Plan.

$1.9 trillion is 9% of US national income. Democrat Senator Bernie Sanders said, ‘[This] is the most significant piece of legislation to benefit working families in the modern history of this country.’ Mitch McConnell, the Republican Senate minority leader, condemned the proposal: ‘The Senate has never spent $2 trillion in a more haphazard or less vigorous way’. All the Republican senators voted against the Bill; many denounced it as ‘socialism’. Some $1 trillion will be used as subsidies to households in the form of cheques, child tax credits and higher unemployment benefits, plus $150bn will be directed to vulnerable businesses. People on incomes below $75,000 a year should get payments of $1,400 per person. For eligible parents, there are tax credits of $3,600 for children under six and $3,000 for children under 18. An emergency top-up to unemployment benefits worth $300 a week will be extended until September this year. $750bn will be used for mass vaccinations and to fund states and local governments. It is reckoned that, together with food assistance, rental and mortgage relief and increased healthcare subsidies, the measures will cut US poverty by one third and child poverty by half. However, the payments will be phased out towards the end of 2021 and in to 2022 – it is a short-term relief measure.

An optimistic gamble

Responding to the spending package, the Organisation for Economic Co-operation and Development revised estimates of US economic growth for 2021 upwards from 3.3% to 6.5% and said that world growth would consequently rise by 1%. While the OECD forecasts that by the end of 2022 US output will be 1% above its pre-pandemic trend, that of the eurozone will be 2% behind trend and that of Britain 4% down; ‘the US’s relative decline is a little postponed’, commented the Financial Times.

In late March 2020, the Trump administration injected $2.2 trillion into the US economy and a further $900bn in December. Much of this government spending helped to boost the wealth of US billionaires, which has grown by $1.4 trillion since the Covid-19 pandemic began. The nine richest US citizens are collectively $380bn better off. The extra money has fuelled share prices and dividends. In the week after Biden signed the $1.9 trillion relief bill share prices have again risen, adding to executive pay which is often tied to investor and shareholder performance. With the latest relief cheques due to arrive in accounts on 17 and 18 March, a survey by Deutsche Bank found that two thirds of individual investors under the age of 34 intended to use some portion of their cheques to buy stocks. In the absence of career ladders and any other prospects of increasing incomes, young people are choosing to gamble. Rather than redistributing income and equalising wealth, the increased state expenditure ends up widening inequality.

Despite the Democrats saying on the campaign trail that they would increase the federal minimum wage to $15 an hour, they failed to get an increase into the stimulus package. It remains at $7.25 an hour and has not been increased since 2009; the longest time it has not been raised since the 1938 Fair Labour Standards Act introduced a minimum wage. Those opposed to the proposed increase were the Republicans and several Democrat representatives, backed by the US Chamber of Commerce, the Business Roundtable and the National Restaurant Association, who back poverty wages to make their profits. They argued that a higher minimum wage would cost jobs and so the choice is between low wages or no wages. A similar argument was put forward by employers in favour of retaining child labour in Britain in the 19th century. Wherever legislation restricted the hours worked by children, manufacturers complained that parents withdrew their children to sell them wherever ‘freedom of labour’ still prevailed; ending child labour would deprive poor families of an income and would close factories, rendering adults jobless as well (Karl Marx, Capital Vol One). Today, the employers say that if the minimum wage is increased small firms will go out of business, consequently, the low-paid worker and the small business have a shared interest in uniting against raising the minimum wage.

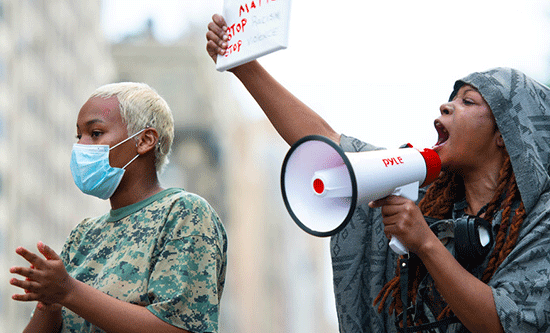

Biden’s spending package is generally popular – understandably so when many people need extra cash. Trump’s electoral defeat demonstrated a demand by the working class and a substantial part of the US middle class for a change in direction. The US ruling class is attempting to buy off the masses. On 13 March 2021 Minneapolis City Council agreed to pay the family of George Floyd $27m; Floyd was murdered by Minneapolis police on 25 May 2020. The family brought a civil case against the city authorities for violating George Floyd’s rights when they restrained him, and for allowing a culture of excessive force, racism and impunity to flourish in its police force. $27m is one of the highest such payments made. In September 2020, Louisville paid $12m to the family of Breonna Taylor who was killed by police officers in her flat by police officers. Neither this money nor the $1.9 trillion package will heal the wounds that mark US society.

Poverty and despair

One in seven US people are in poverty; for black people the proportion is closer to a fifth. In December, some 12% of people reported not having enough to eat, compared with 9% before the pandemic. While the official unemployment rate has fallen from 14.8% in April 2020 to 6.3% in March 2021, millions of people have dropped off the unemployment register and have stopped looking for work. Jay Powell, chair of the US Federal Reserve, said ‘Published unemployment rates during Covid have dramatically understated the deterioration in the labour market.’ By March 2021 there were ten million fewer jobs than a year before; the US labour force participation rate is 61%. More than a third of those in the lowest paid work have lost their jobs during the pandemic, compared with about 6% in the highest paid work. 46% of US women workers have jobs with a median wage of $10.93 an hour. Over the past year the US retail sector has lost 362,000 jobs, 98% of which belonged to women.

On one estimate, just over a quarter of jobless workers receive federal benefits, in 17 states it is 20% or less. This is due to underfunding of the schemes and rules that hinder applications for benefits. The Government Accountability Office reports that of the 8.5 million children eligible for childcare subsidies, only 1.5 million received any; 40% of children from households below the poverty line were left out. 55,000 people sleep in New York City homeless shelters each night.

Along with failing to raise the minimum wage, the Biden administration has not addressed the massive student loan debt burden, nor has it taken any steps to protect the right of workers to organise; in 1965 a third of the US workforce was unionised, now it is about 10% – this adds to the inequality. The healthcare problems that stem from the US’s for-profit system is not addressed; about half of US workers rely on employer-provided health insurance, so by June 2020 nearly eight million adults and seven million dependants had lost their coverage through unemployment.

Keynesian economists (after the British economist John Maynard Keynes) hope that a rise in government spending, such as the $1.9 trillion stimulus, will feed through the economy to in turn stimulate private sector investment and growth, which will allow the initial government borrowing to be painlessly repaid. This will not happen. The overall rate of US profits is too low for any sudden spur in consumption to induce corporate investments and the scale of US individual and corporate indebtedness will swallow up the additional money injected.

While the productivity of labour in the US more than doubled between 1979 and 2020, average hourly pay rose 11.6% over the same period. Profits and dividends grew as wages stagnated and consumer debt (for example, credit cards loans, mortgages and student loans) ballooned to $14 trillion. By December 2020, 12 million people owed nearly $6,000 each on average in rent and utility bills; many face evictions. The $1,400 cheques could disappear from accounts as soon as they arrive because there is nothing in the legislation to stop debt collectors seizing the money to pay off private debts. Tens of millions of US people have debt collection judgments against them, disproportionately black people.

US corporate debt was $3.3 trillion in 2007 and by 2019 had risen to $6.5 trillion. In 2020 US companies added $2.5 trillion to their debt. The number of so-called zombie companies whose interest payments are higher than their profits for three years running is now close to an all-time high. Any rise in interest rates will prove fatal for many firms and jobs. US government debt is now $27.76 trillion or 111% of Gross Domestic Product, having tripled in real terms since 2000.

Last year, the Nobel Prize winner Angus Deaton and the economist Anne Case published a best seller: Deaths of Despair and the Future of Capitalism. It deals with life and death in the late 20th and early 21st century US. It records the growing toll of deaths from drug overdoses, suicide and chronic liver disease. It is testimony to the social crisis pervading capitalist society. The US National Institute of Mental Health states that ‘major depressive disorder affects approximately 14.8 million American adults, or about 6.7% of the US population age 18 and over in a given year’. 42.4% of the US population are obese and the number of severely obese is close to 10%. The murder rate in 20 US cities is up 6% in 2020 over 2019. According to the National Coalition Against Domestic Violence, on average every nine seconds in the US a woman is beaten, with women aged between 18 and 25 being the most frequent victims. Black women are 35% more likely to suffer abuse than white women. This is the vortex into which the stimulus is thrown.

The Biden stimulus package is greeted with a fanfare of anticipation and shouts of approval. The ruling class is trying to keep its confidence up: it is whistling in the dark.

FIGHT RACISM! FIGHT IMPERIALISM! 281 April/May 2021